The emerging trend in Business

Learn about Green Finance

The recent buzzword ‘green finance’ may have caught your interest when you scan through the headlines of newspapers. As green finance slowly gains momentum in an array of financial cities, it is evident that these seemingly uncorrelated two ships, ‘’Green’’ and ‘’Finance’’ have sailed towards each other. So the question lies, what exactly is green finance and why does it exist? And most importantly, why do we care?

By definition, green finance is any financial activity in hopes to achieve a better environmental output. It can be a loan or an investment to purchase environmentally-friendly products or services. Green finance is being kindled when the 2015 Paris Climate Agreement was agreed upon, with its mission to alleviate the problem of global warming by different initiatives. We all have a consensus that green products are generally more expensive, as they involved more complex procedures in production and recycling. As a result, consumers often shy away from these purchases, and these products are portrayed as a more luxurious option. Therefore, we need a solution that can consistently attract customers to purchase and incentivize businesses to develop this idea. This is where finance plays its key role in the green finance industry. The financial industry mobilizes and channels funding and investments to sustainability and its related development, which will then lower production costs of green products and attract more customers. Ultimately, influencing a larger proportion of products and corporates to go green.

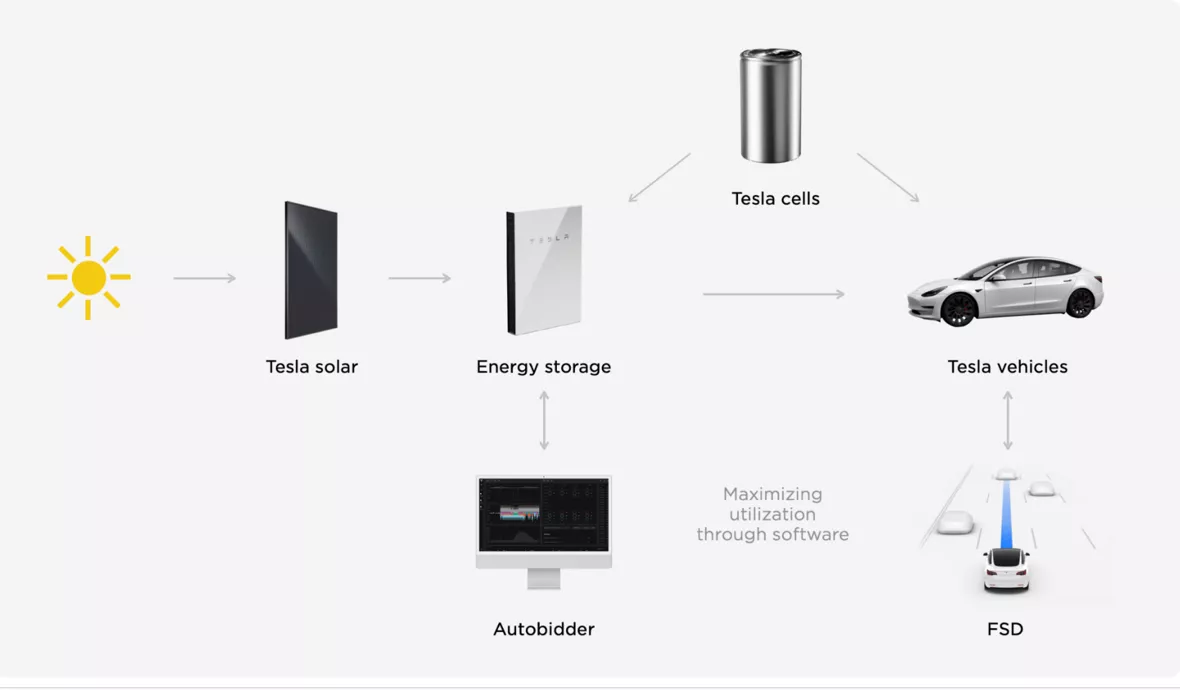

We can take a look at one of the most iconic pioneers- Tesla: ‘’The very purpose of Tesla’s existence is to accelerate the world’s transition to sustainable energy.’’ According to Tesla. Apart from the well-known electrical cars, Tesla is also trying to build a sustainable energy and transportation ecosystem, which society can definitely leverage on. Perhaps at a time not too long from now, we would be seeing an ecosystem that is completely self-sustainable and with 0 net carbon emission.

Greenwashing

The concept of green finance sounds too ideal and flawless, right? After all, just like every prevalent trend, it has its own dark side. Recall the last time you chose a product because of the ‘’environmental-friendly’’ actions that the corporate has taken? In fact, You might have been a victim of greenwashing. Greenwashing is an attempt to create a false impression on how environmentally sound a company’s product is, in order to mislead customers to buy their products. This includes making exaggerating or partially correct claims that their products are energy-efficient, produced from recycled materials, just to name a few. One of the most controversial incidents- McDonald’s, when they introduced paper straw in 2019 which was proved not recyclable and did not reduce the level of waste at all. Take into consideration another example: In the fast fashion industry, H&M introduced a line of ‘’green clothing’’ named ‘’Conscious’’ in 2019. They claimed to use ‘’organic’’ cotton and recycled polyester, but it was being criticized by the Norweigian Customer Authority that there was not enough information regarding sustainability. The product line was suspected to only be a marketing strategy by making deceptive claims.

So as consumers, what can we do?

"Make sure that these claims are made or validated by a third party," said Cynthia Cummis, co-founder of the Science-Based Targets. In addition, we could also take a broader look at the policies of the whole company instead of focusing on a claim of a particular product. Indeed, as global citizens, we should not just be complacent with the current green measures but take a step further to help the environment that we are living in because our future is in our own hands.

![[Sustainable Living Pod EP.1]Introducing Hong Kong Jockey Club Sustainable Campus Consumer Programme](/sites/default/files/impact/image/What%20does%20HKJCSCCP%20do%20in%20hkust.png)